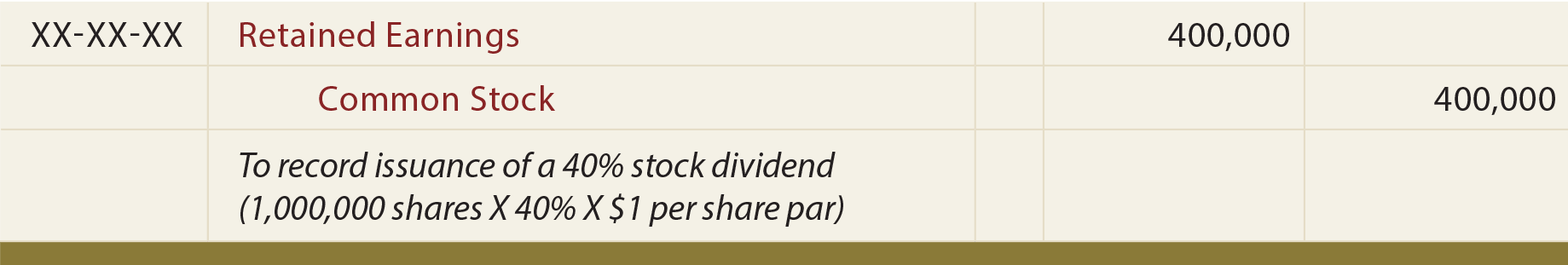

Record the Stock Dividend Assuming a 2-for-1 Stock Split.

The market price of the common stock is 44 on this date. If no entry is.

Stock Splits And Stock Dividends Principlesofaccounting Com

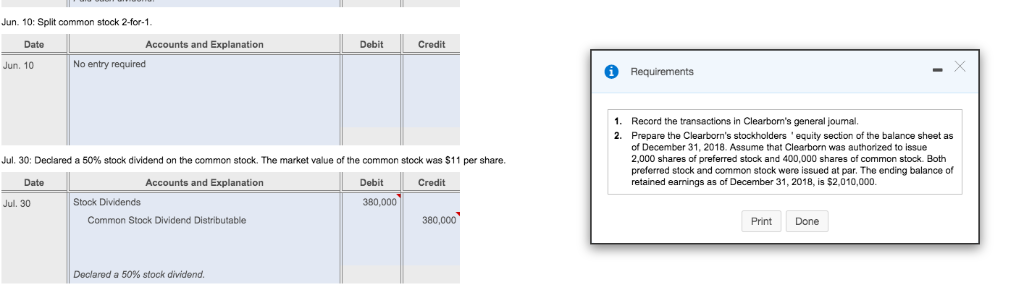

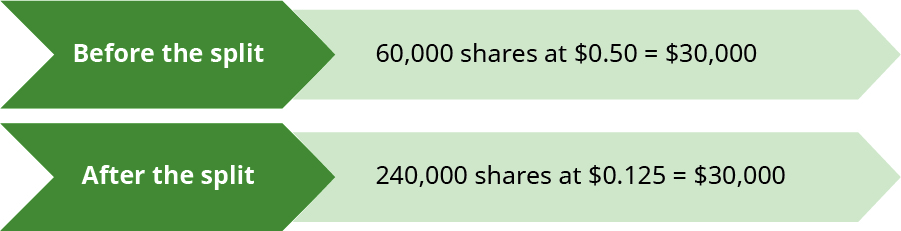

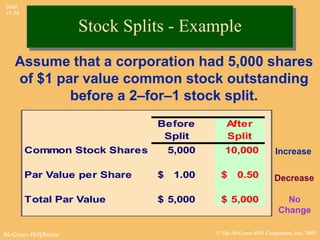

Stock splits are events that increase the number of shares outstanding and reduce the par or stated value per share.

. Barbara Bloomington owned 1000 shares of Hoosier stock with a tax basis of 100 per share. The board of directors would like the shares of common stock to be trading near 50. To achieve this the board approved a 3-for-1 stock split.

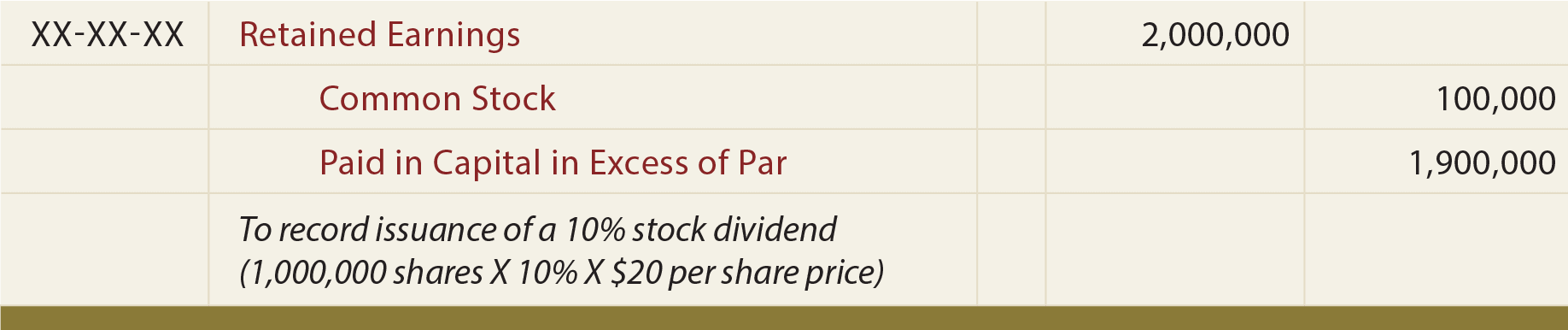

Declared a 10 stock dividend to stockholders of record on July 15 attributable July 31. Prepare the journal entry to record Zende Companys issuance of 82000 shares of 6 par value common stock assuming the shares sell for. For example assume a company owns 5000 common shares outstanding and declares a 50 common stock dividend.

On September 1 the board of directors of Colorado Outfitters Inc declares a stock dividend on its 29000 20 par common shares. If the 100 stock dividend is for the exactly the same stock it is basically the same as a 2-for-1 stock split. The market price of the common stock is 36 on this date.

Dividends are not paid on treasury stock Pays the cash dividend declared on June 1. Suppose for example David Inc. Prior to the split the market price per share was 36.

Record the stock dividend assuming a small 10. Record the necessary journal entries assuming a small 10 stock dividend a large 100 stock dividend and a 2-for-1 stock split. Record the stock dividend assuming a small 10 stock dividend.

The market price of the common stock is 30 on this date. The total fair market value of. Existing shareholders would see their shareholdings double in quantity but there would be no change in the proportional ownership.

For 1-3 Record the necessary journal entries assuming a small 10 stock dividend a large 100 stock dividend and a 2-for-1 stock split. In addition the par value per stock is 1 and the market value is 10 on the declaration date. Announced a 2-for-1 stock split.

Currently has 50000 shares of 10 par value common stock outstanding and decides a 2-for-1 stock split. Record the necessary journal entries assuming a small 10 stock dividend b. Will have 100000 shares of 5 par value common stock outstanding but the total par value of shares will remain the same as before the split.

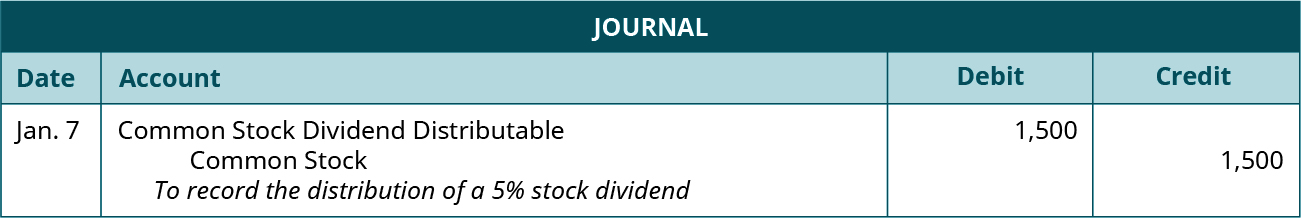

Prepare the necessary journal entries assuming the following. The total fair market value of the stock distributed was 1500000. Assuming the above date sequence for ABC Corp if the company decided to pay a dividend of 1 per share it will equate to 10 million of distributions.

And 7 cash per share. Assume that a corporations common stock has risen to 150 per share and there are 100000 shares issued and outstanding. Stock Splits After the Record Date.

In a 2 for 1 stock split Barbara would allocate half of the basis of the old stock 100 to the new stock making her tax basis in the old and new stock 50 per share. On September 1 the board of directors of Colorado Outfitters Inc declares a stock dividend on its 24000 15 par common shares. On September 1 the board of directors of Colorado Outfitters Inc declares a stock dividend on its 16000 7 par common shares.

The board votes a 2-for-1 stock split. Record the stock dividend assuming a 2-for-1 stock split. LO3 Hoosier Corporation declared a 2-for-1 stock split to all shareholders of record on March 25 of this year.

On September 1 the board of directors of Colorado Outfitters Inc declares a stock dividend on its 25000 16 par common shares. If however the 100 stock dividend is to give you a different stock then this is typically due to a corporate reorganization or demergerspinoff event. After this the Inc.

Issued the shares for the stock dividend. Record the necessary journal entries assuming a small 100 stock dividend. Lets assume the stock split on 2016-05-10 2 days before the pay date but 13 days after the record date.

On July 1 the market price of the stock was 13 per share. After the stock split there are 300000 shares issued and outstanding. The market price of the common stock is 44 on this date.

Record the stock dividend assuming a large 100 stock dividend. For example a 2-for-1 stock split would double the number of shares outstanding and halve the par value per share. Hoosier reported current EP of 600000 and accumulated EP of 3000000.

ACCT 402 Chapter 7 Stocks 50. The new stock is allocated part of the tax basis of the old stock based on relative fair market value. The market price of the common stock is 49 on this date.

This affects the share price as well as the dividend paid by each share of stock. Hoosier Corporation declared a 2-for-1 Stock Split to all shareholders of record on March 25 of this year. Has 11000 shares of 2 par value common stock outstanding.

Epic declares a 15 stock dividend on July 1 when the stocks market value is 18 per. On September 1 the board of directors of Colorado Outfitters Inc declares a stock dividend on its 10000 1 par common shares. 6 cash per share.

For example if you own 50 shares in a company that completes a 2-for-1 split youll be issued 50 additional shares. A stock dividend is considered a large stock dividend if the number of shares being issued is greater than 25. Record the necessary journal entries assuming a small 10 stock dividend a large 100 stock dividend and a 2-for-1 stock split.

Hoosier reported current EP of 600000 and accumulated EP of 3000000. A stock split is an action taken by a company to divide its existing shares into multiple shares. Declares a cash dividend of 175 per share to all stockholders of record on June 15.

The board votes a 100 stock dividend. Record the necessary journal entries assuming a small 10 stock dividend b. Briefly discussed the accounting and securities market differences between these two methods.

The market price of the common stock is 45 on this date.

Stock Splits And Stock Dividends Principlesofaccounting Com

Solved Clearbon Manufacturing Co Completed The Following Chegg Com

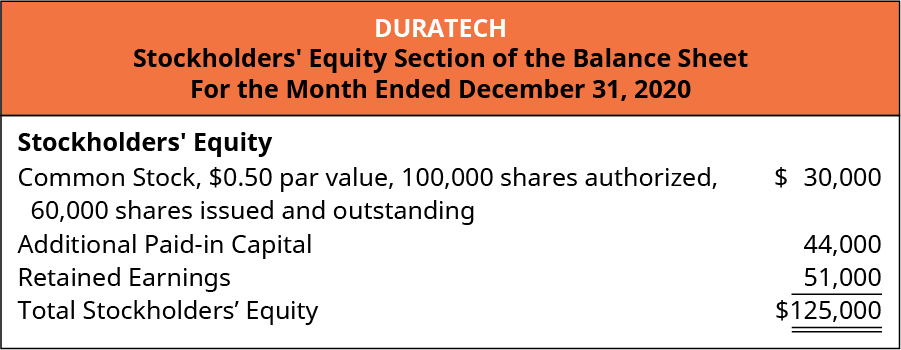

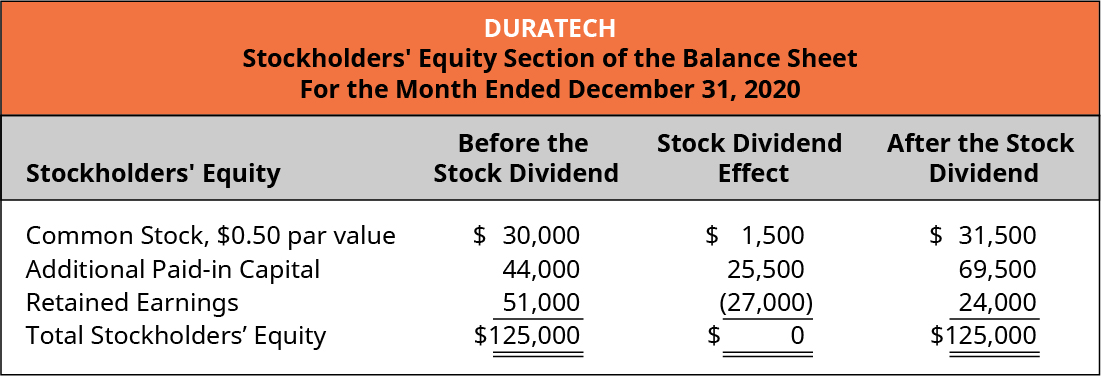

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

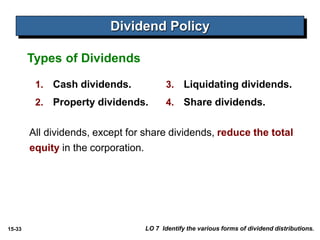

Chapter 18 Dividend Policy 18 1 Pearson Education

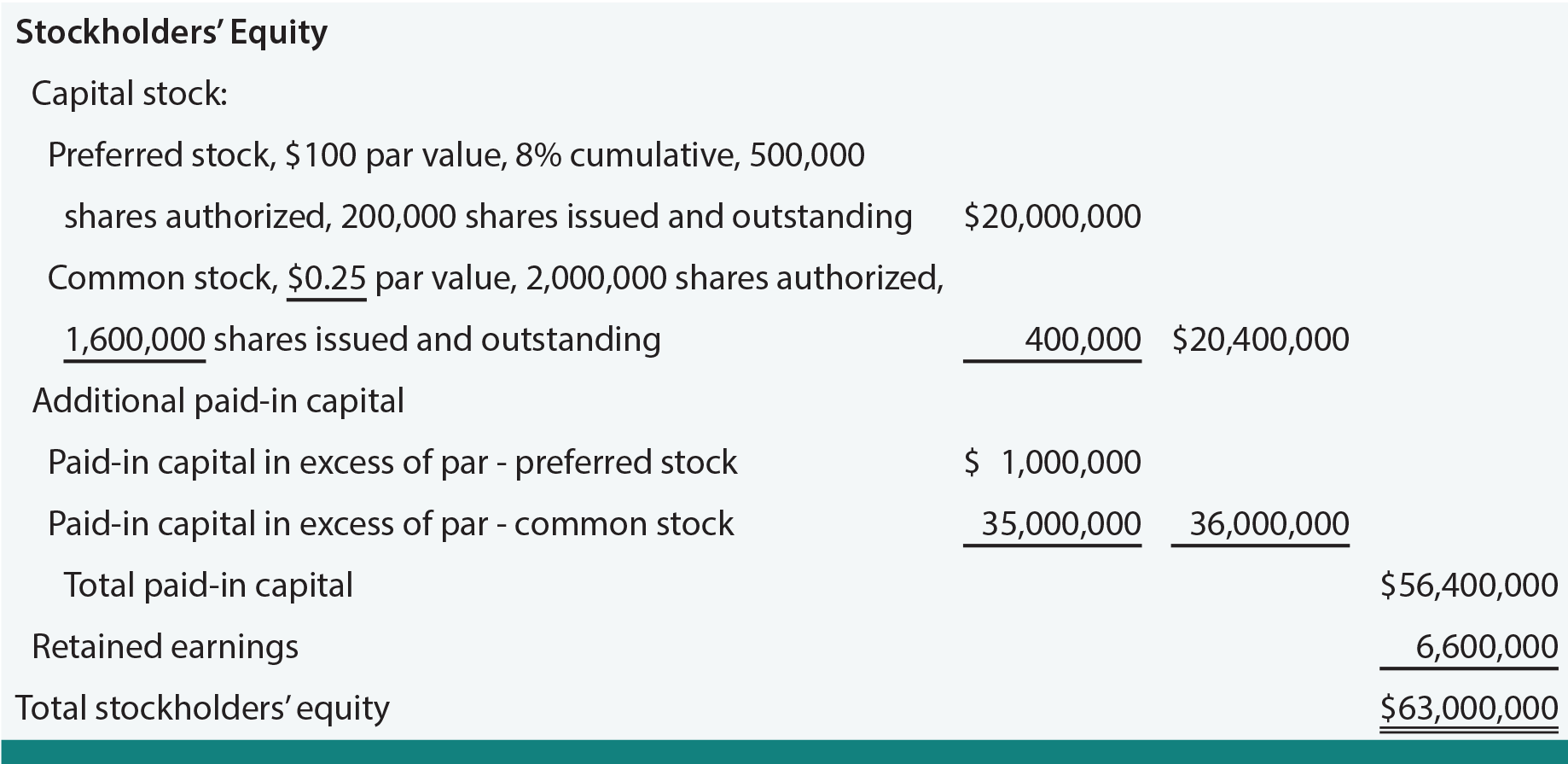

Solved Kohler Corporation Reports The Following Components Chegg Com

Stock Splits And Stock Dividends Principlesofaccounting Com

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Stock Splits And Stock Dividends Accountingcoach

Stock Splits And Stock Dividends Principlesofaccounting Com

Dividend Policy 11 1 Dividend Policy Determining How

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Business Finance Mgt 232 Lecture 26 4 1

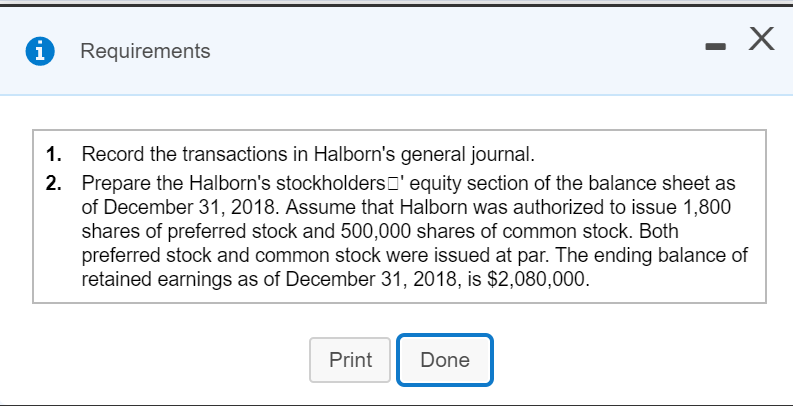

Solved Requirements Record The Transactions In Halborn S Chegg Com

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Record Transactions And The Effects On Financial Statements For Cash Dividends Property Dividends Stock Dividends And Stock Splits Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment