Is Bad Debt a Fixed or Variable Cost

Cost of the discount 1. Make your own list based on your business model.

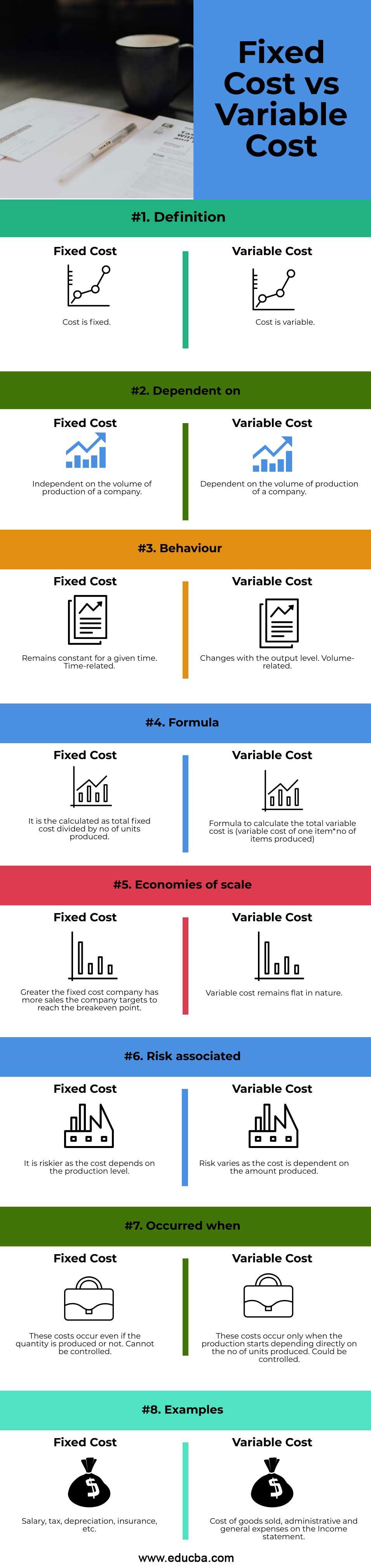

Fixed Vs Variable Top 8 Differences To Learn With Infographics

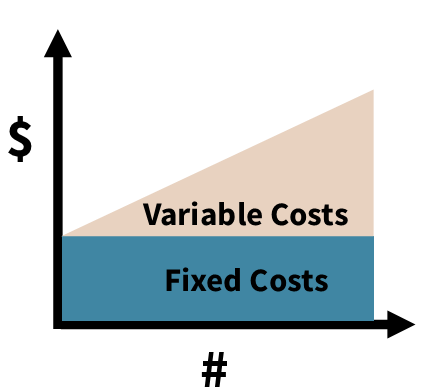

Fixed and variable costs one of the most popular methods for classifying costs both help provide a clear overview of a businesss cost structure.

. A direct fixed cost is a cost which is directly related to the production process or service delivery but does not vary as per activity level. Depreciation cannot be considered a variable cost since it does not vary with activity volume. Purchases Cost of Goods Sold Repairs and Maintenance.

Fixed costs are 100000. Fixed costs per annum. The difference between fixed and variable costs is that fixed costs do not change with activity volumes while variable costs are closely linked to activity volumes.

When a firm pays an individual a salary it is regarded as a fixed cost of doing business. The high-low method of accounting helps in this bifurcation of variable and fixed costs. How many clinic visits are required for the operation to breakeven.

D Fixed Assets Matching Items Answer Items A. Cost of sales comprises 80 variable costs and 20 fixed costs while the companys required rate of return is 12. List of Possible Fixed and Variable Expenses The following lists show some of the fixed and variable expenses you might need to estimate for determining if your business idea will be profitable.

A direct fixed cost is the second type of direct costs the first being direct variable cost. Where FC Fixed Cost VC Variable Cost and DSO Days sales outstanding. Variable expenses regularly change and may be directly influenced by the choices you make on a day-to-day basis.

In recent times OBA Ltd. Wages will be a typical cost of doing business and will generally remain fixed over a period of time. Find out their differences.

It is necessary to divide this semi-variable cost into fixed and variable costs to arrive at the total cost of a product and determine the selling price. Variable costs and fixed costs in economics are the two main types of costs that a company incurs when producing goods and services. Examples include direct materials cost.

Variable costs are 50 cents per unit. How many visits are required for the clinic to earn a pre-tax profit of 200000. Cost of sales is 75 of sales and bad debts are 4 of sales.

Unlike fixed expenses variable expenses are much. Cost of Goods Sold. Cost of Marginal Bad Debts 4.

Thus fixed costs are incurred over a period of time while variable costs are incurred as units are produced. Show all calculation steps. Figure out how much you can afford to pay towards your debt each month get a side hustle to boost your debt payoff and dont add to your debt.

Extension of credit to low quality-rate customers results into increase in bad debt losses. Inventory 5 The company sells widgets for 3 each. Bad debt losses Annual credit sales X.

These lists dont include any personal expenses like health insurance or car lease payments. This cost would remain the same even if more or fewer units are produced. With a variable cost the per unit cost stays the same but the more units produced or sold the higher the total cost.

Increase decrease units sold annualunits sold x increase decrease Profitlost gained increase decrease unitssold x selling price variable cost Fixed cost is not affected by change in credit terms. Variable costs are those which are directly proportional to sales volume. A variable cost is one that may increase or decrease over the course of an accounting period.

This is the loss due to default customers. Bad debt losses are calculated as a percentage on sales as shown in equation below. Currently allows customers 60 days credit.

Average bad debt per visit 20. The number of units the company needs to sell to break even is. By understanding the differences between fixed and variable costs you can make sound educated decisions about your businesss expenses product pricing and the volume of products you need to.

Direct materials is a variable cost. Profitloss from the change is sales. The final word on fixed and variable expenses Knowing the difference between fixed and variable costs can help you find ways to save money and budget better.

Definition of variable expenses. Variable costs are the costs that change in total each time an additional unit is produced or sold. Ie no sales no variable costs.

A semi-variable cost is a cost have characteristics of both fixed and variable costs. Many costs includes fixed as well as variable portion for example electricity cost in which there may be some portion of expense which remains fixed while some change due to higer or lower production. Variable costs per visit 16.

Variable expenses can be contrasted with overhead such as the cost of your HR team that doesnt change with your business volumes or strategy. Variable cost per unit remains constant. Depreciation is a fixed cost because it recurs in the same amount per period throughout the useful life of an asset.

A fixed salary is compensation that is paid to an employee. Has been facing liquidity problems and plan of changing.

Cost Structure In 2021 Accounting And Finance Cost Accounting Finance Investing

Operating Leverage Formula And Excel Calculator

High Low Method Accounting Meaning Formula Example And More In 2021 Accounting Accounting Principles Accounting Education

Variable And Fixed Costs Fixed Cost Accounting And Finance Accounting Basics

Identify Your Expenses And Know Where Your Money Is Going Credit Simple

Variable And Fixed Costs Fixed Cost Accounting And Finance Accounting Basics

New Business Startup Spreadsheet Template Exceltemplate Xls Xlstemplate Xlsformat Excelformat Microsoft Business Budget Template Budget Template Start Up

Accounting Archives Brandongaille Com Accounting Accounts Receivable Bad Debt

Fixed Vs Variable Top 8 Differences To Learn With Infographics

Variable Costs A Cost That Varies With The Level Of Output Accounting And Finance Cost Accounting Basic Economics

8 Steps Of The Accounting Cycle Accounting Basics Accounting Cycle Accounting

Identify The Cost Elements Related To Service Product Research Washington University In St Louis

F I N A N C I A L L I T E R A Cy F R I D A Y Fixed Expenses Vs Variable Expenses Outgoing Items How To Be Outgoing Budgeting Financial Literacy

Types Of Costs And Their Basis Of Classification Accounting Education Cost Accounting Bookkeeping Business

Purely Variable Costs For Example Direct Materials Variable Costs They Are Fixed In The Short Term For Example Direct Labour Fixed Costs They Become Va

Fixed And Variable Expenses Inc Com

Fixed Vs Variable Expenses What S The Difference Forbes Advisor

Comments

Post a Comment